What is STO?

Security Token Offering - a regulated token sale representing real securities, combining crypto efficiency with legal compliance.

Learn More About Crypto Investing

Get weekly insights on tokenomics and pre-IPO opportunities.

Examples

- 1.SPiCE VC tokenized their venture fund, allowing secondary trading of VC fund interests - traditionally illiquid.

- 2.Overstock's tZERO exchange trades security tokens including its own TZROP token.

Frequently Asked Questions

What is a Security Token Offering?

How is an STO different from an ICO?

Can anyone invest in STOs?

Related Terms

More trading Terms

Crypto Presale

An early token sale before public launch - the opportunity to buy at the lowest price, but also the highest risk of scams and failures.

ICO

Initial Coin Offering - the 2017 fundraising craze where projects sold tokens directly to the public, raising billions before regulations caught up.

IDO

Initial DEX Offering - a token launch on decentralized exchanges, providing immediate liquidity without centralized exchange gatekeepers.

Token Generation Event

The moment when tokens are created and distributed - when your investment transforms from a promise into actual blockchain assets.

Airdrop

Free tokens distributed to wallet addresses - sometimes for early users, sometimes for marketing, sometimes worth thousands of dollars.

Whitelist

An approved list of wallet addresses allowed to participate in a token sale, NFT mint, or exclusive access event.

Related Articles

Presale vs Seed Rounds vs Pre-IPO: The Complete Comparison

Presales, seed rounds, and pre-IPOs aren't just different names for the same process. Each represents a distinct stage of fundraising with its own rules, participants, and purpose.

Breaking the Barrier: How Retail Investors Finally Access Private Deals

For years, private markets felt like a private club - full of high-growth deals, but closed to everyday investors. Today, tokenization and platforms like IPO Genie are breaking those barriers.

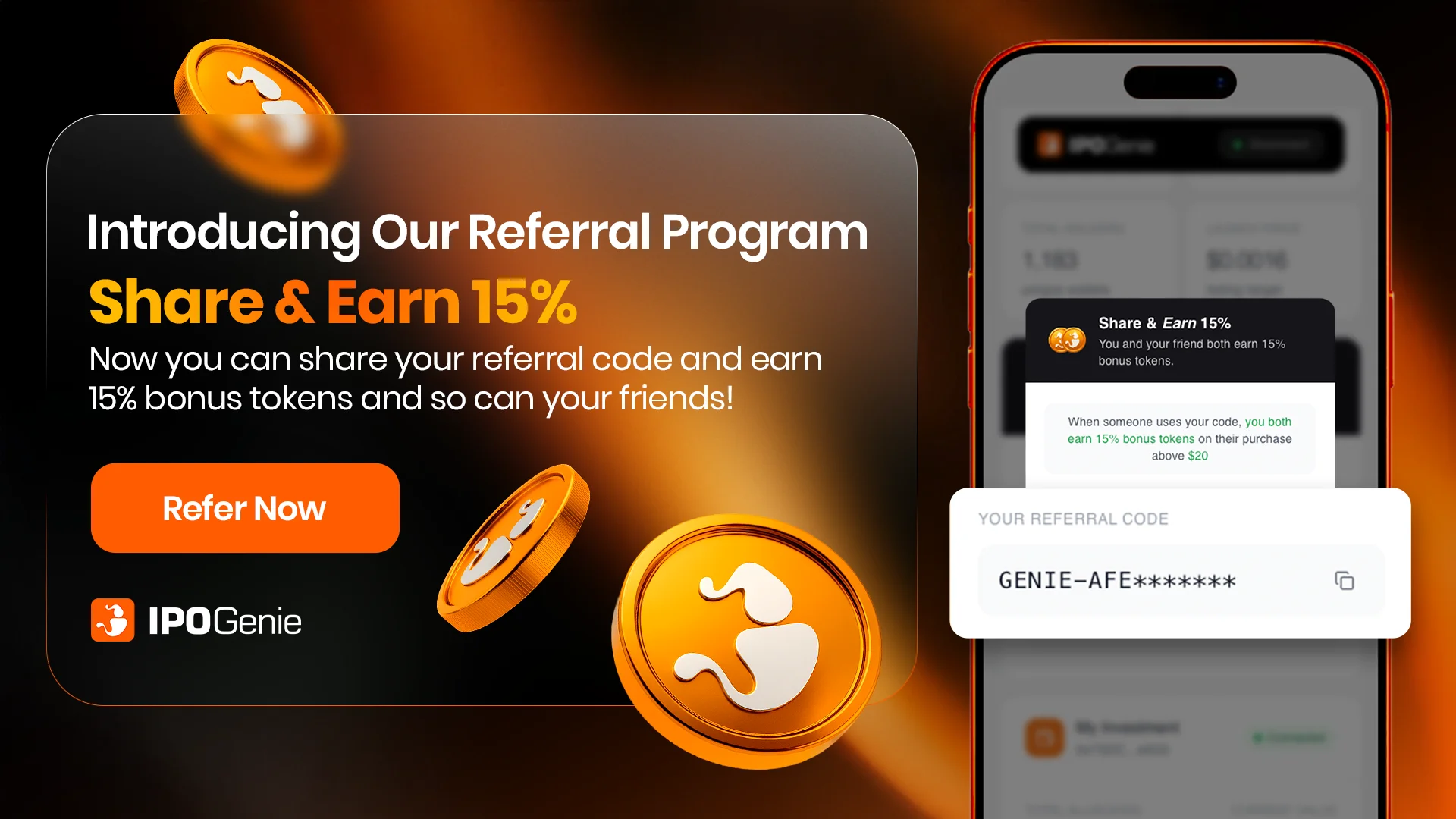

IPO Genie Referral Program is Live - Share & Earn 15% Extra $IPO

We're excited to introduce a new feature on our website: the IPO Genie Referral Program! Share your code, and when a new user completes a $20+ buy, both wallets receive 15% extra $IPO.